The real estate technology reckoning

Change is the only constant, goes the adage. The commercial real estate market is no exception to this universal truth; change has been relentless for the industry in recent years and keeping up with its consequences is a formidable task.

The scale and impact of change is growing, to such an extent, it seems misguided to think any individual company can adapt effectively on their own. That’s why we believe it’s an important time for industry peers to come together and share opinion, experiences and ideas, to effectively navigate a successful path forward.

With this aim, essensys assembled several major European office players to debate the state of the industry and explore what could be done to help its participants adapt successfully. Representatives from the following companies took part in this high-profile roundtable:

- AXA IM

- British Land

- Bruntwood

- Cushman & Wakefield

- Grosvenor

- Hines

- Landmark

- Landsec

- LGIM

- The Office Group

- essensys

Flight to quality

The group came together to debate the state of the office market and how landlords and operators are adapting to the flight to quality we’re experiencing. Occupiers are expecting more than ever and with data taken from CoStar showing vacancy rate growing across the UK, it’s evident they’re not finding what they’re looking for. Creating the types of product and experience occupiers now expect is not easy, consequently building technology has never been more important as the industry works to address these heightening expectations.

“There is a genuine flight to quality… And that is, still well-located, well-designed buildings. But it is also more about the experience within those buildings, be that the physical experience and the digital experience.” – James Lowery

Below, we provide an overview of the themes discussed by those present at the table. It was felt that addressing these topics was critical to successfully adapting and remaining competitive in the office market today and into the future.

The macro-economic picture

Participants talked through what they felt were the most pressing macro-economic challenges. One topic discussed was the growing importance of operational efficiency as service charges risk doubling in the near future making energy-efficient buildings even more of an attractive option moving forward.

It was generally accepted that the supply of flexible space will grow, mainly due to the level of uncertainty felt by many occupiers. A figure of between 10 and 20% was settled upon as an estimate for the amount of flexible space that a landlord would shift to flex and it was agreed by all that to do nothing in the flexible space market was incredibly risky and would lead to a large disconnect in supply and demand.

The relationship between landlord and operator was discussed; there are challenges as relationships grow in complexity due to more stakeholders than before being involved in real estate decisions. Engagement with customers can involve their HR, finance, technology & sustainability teams. This makes navigating the relationship with key clients more complex than before.

It was also referenced that budgets are under tighter scrutiny than before and that any investment in technology has to be justified to a far higher standard than it had been in the past; demonstrating how it helps drive operational efficiencies was one of the examples offered.

Immediate pain points

The discussion on industry challenges led to conversation on what impact this was having on landlords and operators today. One of the impacts being felt by all round the table was the complexity they were faced with when trying to make sense of the technology available to them. One example flagged was tenant experience apps; there are so many of these, some do different things and not all will talk to each other or integrate with wider technologies. Participants also raised the fact that occupiers may have preferences or attempt to build their own infrastructure which can explode into complexity for those who are responsible for operating the space.

This, at times, leads to tension between technology companies and landlords; the latter don’t always feel the former understand their needs in enough detail. Actual need for tech versus the need perceived by the vendor remains a common annoyance in dealing with proptech. Some round the table felt proptech company founders “do not have shared interests” with property. Short-term sales drive and growth metrics driving certain start-ups was highlighted as concerning contrast to the patient handholding and slower evolution required by real estate’s boardroom culture. Resolving this tension and working together more closely will be key.

Additionally, the way in which occupiers want to communicate with landlords and operators is changing; it was expressed that, generally, communication is currently limited and the two parties tend to meet at set times typically near the end of a lease or when rent is due. This creates a new dynamic for landlords and operators to consider and is part of heightened occupier expectations.

“The whole industry needs to have greater alignment from the landlord, from the operator, from all of the supply chain, to have these common goals to ultimately deliver on the customer need.” – James Lowery

How can technology help?

Despite the frustrations felt around technology and its deployment, its necessity in successfully adapting to shifting occupier requirements was not lost on participants. Having technology that enables landlords and operators to scale an offering or experience across a portfolio in a simple, efficient manner was called out. This would empower property companies to offer occupiers consistent experiences and services as they move from one building to another – this would distinguish an offering. However, avoiding operational complexity and steep overheads whilst scaling an offer like this is essential.

When trying to build compelling experiences for occupiers, several participants shared they were being forced to build their own overarching layer of tech to integrate various apps they opted to use. This is because the apps and technologies chosen didn’t talk to each other effectively. One participant was doing this in-house, another with a partner. There’s a potential gap in the market for a surface layer, combining all applications allowing flexible plug-in, plug-out use.

Efficiency was also discussed in the context of environmental factors and how executive teams are now expected to deliver on specific operational carbon targets. This isn’t something that’s going to go away – it was felt operational efficiency is going to only grow in importance. There’s an expectation for technology to play an important role in solving for this.

Discussion covered whether an opportunity is being missed when it comes to landlords or operators helping instigate relationships between occupiers in a multi-let asset. Whilst not a primary responsibility, it was seen as potential value add. Often occupiers in these assets do not know each other. Connecting them in some way, could create opportunities for sharing intelligence, leads, available space, exchanging materials for reuse and much more.

Looking to the future

With it being accepted that technology is going to play a vital role in the future of real estate, many round the table felt large technology companies are closing in and it’s expected we’ll see some of them more involved in the industry shortly. Apple Wallet is used by access control suppliers and Microsoft is spending a lot on real estate solutions. “They all want a slice of this asset class,” as one contributor put it.

Secondly, as FM, utilities and design become more intelligent, a new service line for landlords could emerge that sells intelligent office space as a separate category. There could be demand from occupiers who want intelligent space that comes with sustainability data and tracking of their occupancy patterns or general usage of the spaces they lease.

Finally, with technology growing in importance to landlords and operators, it’s essential people working in property can use technology properly, or companies risk not realising its full benefit. Data competence, content creation, even behavioural psychology borrowed from other industries to understand how humans change their habits, are all skills and expertise required as real estate continues to evolve.

If you’d like to be considered to join a future roundtable, contact us and we’ll be in touch.

Featured

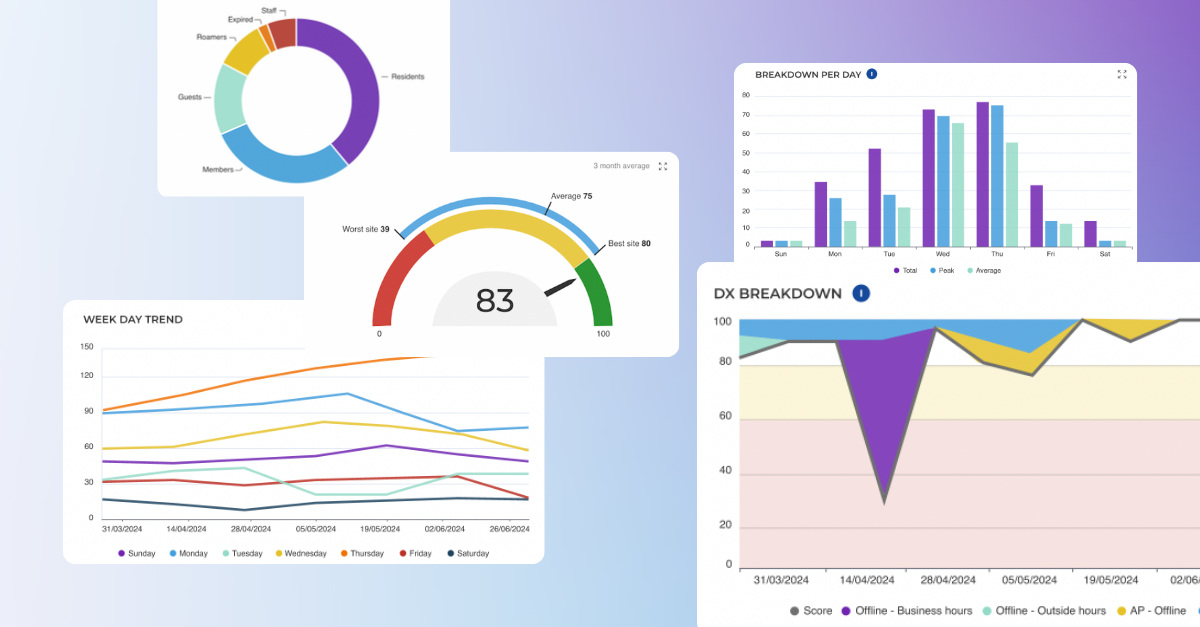

Introducing Intelligence Engine 🎉 Powering meaningful space utilisation & digital experience insights

Intelligence Engine capabilities propels us into a new era of workspace management, bringing meaningful Space Utilisation and Digital Experience insights to essensys Platform.

Read the article

Featured

Future of flex in Europe: attracting and retaining enterprise customers

Gaël Montassier, Co-founder of Startway, shares his insights on the future of flexible workspace in Europe.

Read the article