Market digest

Emerging Trends in Real Estate 2024

PwC have published their top real estate industry trends for 2024 report and here are some of the highlights when regarding the office sector:

Hybrid is here to stay – 30% of total workdays in the United States now involve remote work, as revealed by WFH Research, with 45.9% of workers adopting a hybrid approach (33.7% spending an average of 2.5 days per week in the office) or working fully remotely (12.1%) as of summer 2023.

Improving tech is key – Future offices should prioritize advanced technology, evolving efficient collaboration, providing well-defined spaces, enhancing experiential value, and incorporating designs that meet employee needs for increased productivity.

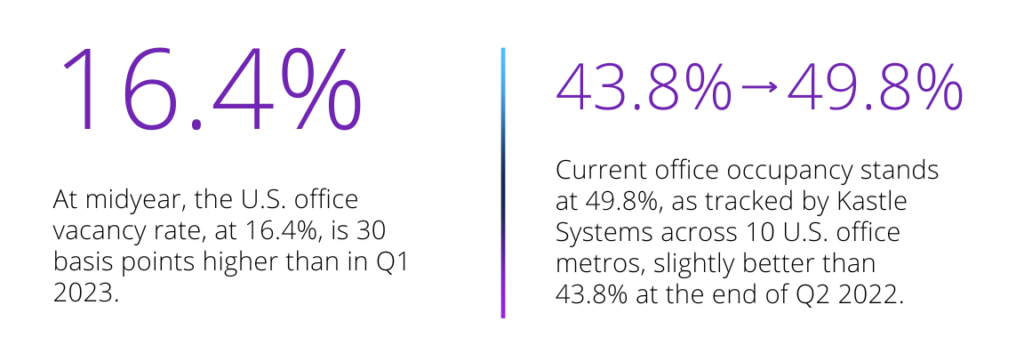

Tenant demands – Tenants now demand higher spending on improvements while occupying less space. Weak office absorption and rising vacancies persist, with a national vacancy rate in the high teens.

Long term success – Despite the negative outlook, the majority office buildings are performing well, where occupancy rates have either improved or stayed the same since 2020. The pandemic has spurred initiatives to redevelop obsolete office buildings where over 100 million square feet are under construction as of September 2023, according to CommercialEdge.

Read the full report here.

Spotlight: European Office Outlook – December 2023

In Savill’s European Office Outlook, they share the top five office themes that they believe are impacting occupancy.

- Occupancy rates – are we reaching the ‘new norm’?

- Demand – who will be taking space?

- Vacancy rates to peak in 2024

- Office development starts to ease back

- Rental growth – the best versus the rest

Read the full European Office Outlook here.

Is hybrid really working?

JLL’s most recent research is shaped by insights from more than 200 CRE decision-makers and incorporates findings from employee surveys, totaling over 20,000 individual responses to answer the question: is hybrid really working?

In short.. yes. On average employees are spending 3.1 days in the office.

However, aligning employer expectations with employee needs is a critical challenge confronting companies and CRE leaders today.

JLL’s research indicates that the most successful adopters of hybrid models excel in three key areas compared to their counterparts:

Download the report for more detail here.

The Workthere Flexmark 4.0

Workthere has just launched the fourth edition of their Workthere Flexmark report which is based on the findings of a global survey of flexible office providers.

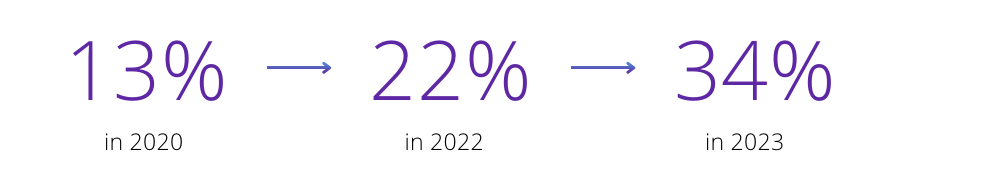

The report delves into factors such as occupancy rates, the demographics of flex space users, client preferences in flexible environments, future projections for the sector, and the strategies employed by flexible operators in addressing environmental, social, and governance (ESG) considerations.

One key observation is that there is a continued increase in large businesses (101+ people) taking up more flexible workspace globally:

Discover more insights by downloading the report here.

Is your real estate technology a value driver?

JLL’s latest research is based on the findings of a survey that asked over 1,000 real estate decision-makers around the world, how their organizations are planning for and implementing new technology.

Considering the challenges of the current market, 85% of respondents plan to increase their investment in technology over the next three years. However, companies are currently struggling to achieve their technology objectives, with fewer than 40% of organizations considering their existing tech programs to be very successful.

The report breaks the findings into 3 key areas:

For more insight, download your copy here.

10 High-Impact Moves to Reduce Total Cost of Occupancy

CBRE Institute’s Fall 2023 report outlines 10 initiatives that CRE&F leaders may consider to navigate the current market challenges and reduce total cost of occupancy.

Learn more by reading the full report here.

U.S. Office Markets: Performance and Prospects | Q2 2023

Collier’s Q2 report looks at the current economic and real estate trends in the U.S. office markets and deep dives into local trends, uncovering what is declining, stabilizing or showing signs of recovery.