Knight Frank | Cresa’s data analysis has been shaped from 640 worldwide companies set against ever-evolving real estate ambitions. (Y)OUR SPACE investigates how the future of the workplace is likely to unfold over the next three years.

Results show that corporate real estate professionals believe complexity in the market is going to increase when considering business strategy, decision making, the workplace, to pick a few.

In addition, the majority of respondents believe their organisation’s work style will be hybrid three years from now at 55.7% followed by office first at 23.2% and remote first last at only 3.4%.

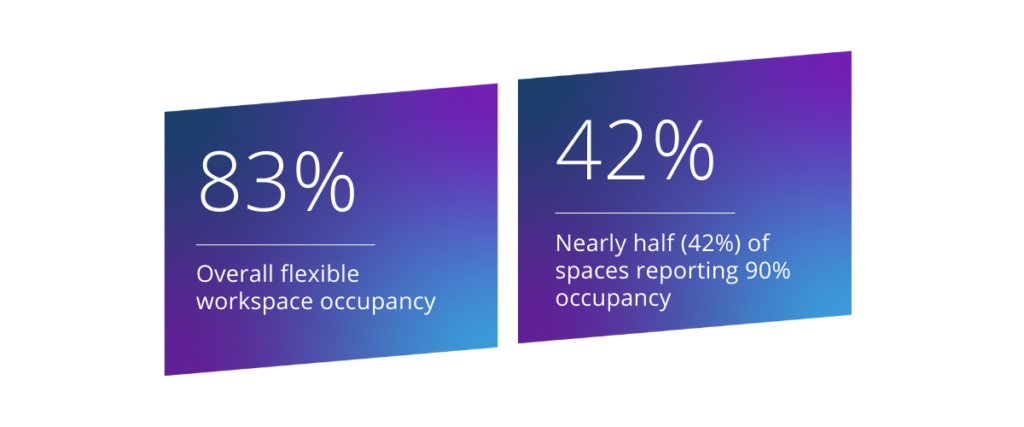

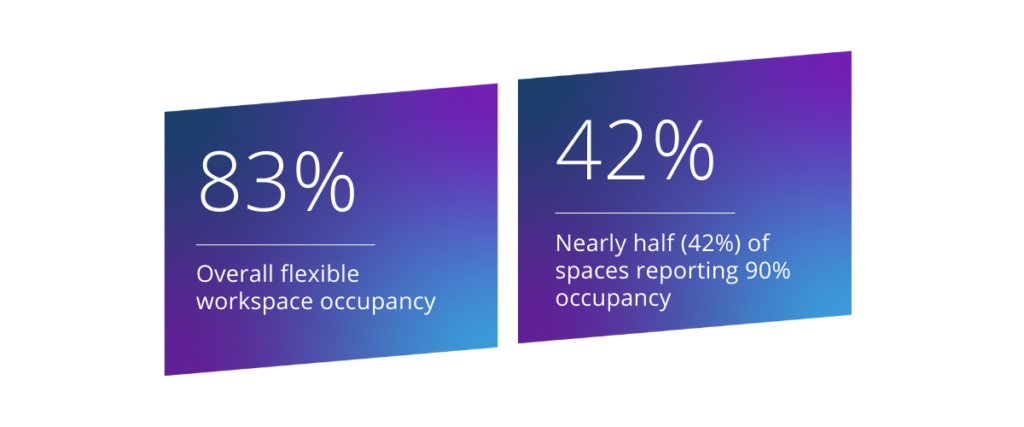

Instant’s latest UK research highlights occupier’s increased demand for flexibility and agility. This desire for additional flexibility is being reflected in the polarisation of occupancy rates between traditional and flex offices.

Occupancy rates within London continue to outpace the UK average sitting at 84%, driven by the adoption of flex from sectors that have typically favoured traditional office leases in the past. One key example is financial services firms, in the last quarter the number of flex desks occupied by the financial sector has doubled.

Clutton’s report focuses on the importance of future-proofing digital infrastructure so that the UK can cope with future technical advances that will come.

When considering the commercial sector, digital connectivity is required for asset owners to meet their ESG targets as ESG monitoring can’t work without high-grade digital capacity.

Also, as technology has evolved so have people’s expectations where, “gigabit connectivity is now more of a utility than a service. It is a necessity,” says Ian Scott, head of property at Cadogan.

Savill’s regional office spotlight provides an outlook for the UK’s Big 6 markets, including Bristol, Birmingham, Manchester, Edinburgh, Leeds and Glasgow.

One of the key observations is that people are still coming to the office and although it may not be five days a week there is a demand for first-rate space ‘where in many cases occupiers who are downsizing are willing to pay an average of 54% more rent per sq ft in order to secure a higher quality of space.’

Savills’ also reported that ‘Five of the Big 6 markets recorded prime rental increases in 2022, with Bristol and Leeds achieving 12% and 6% growth respectively.’

Rental increases are not just a trend for 2023 but will continue an upwards trajectory where Savill’s predict that ‘prime rents could be as high as £45 per sq ft in Bristol, with all of the regional Big 6 markets expecting to surpass the £40 per sq ft in 2025.’

The Urban Land Institute and The Instant Group have surveyed office occupiers, landlords and third-party advisors globally to understand how changing occupier behaviours and broader macro trends impact the demand for workspace.

The findings show a disconnect between landlords and occupiers, therefore, aims to offer solutions to help landlords navigate the changing needs of their occupiers.

Based on 300,000 employee responses collected by Leesman and analysis compiled from 200 industry resources by Gartner, this report from HqO showcases how workplace experience has evolved over the past year, what trends to expect in 2023, and what action real estate and employee experience leaders need to take.

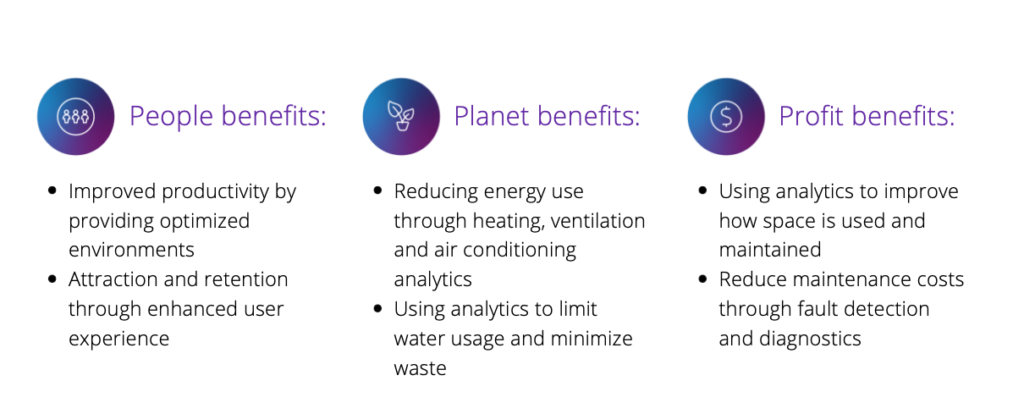

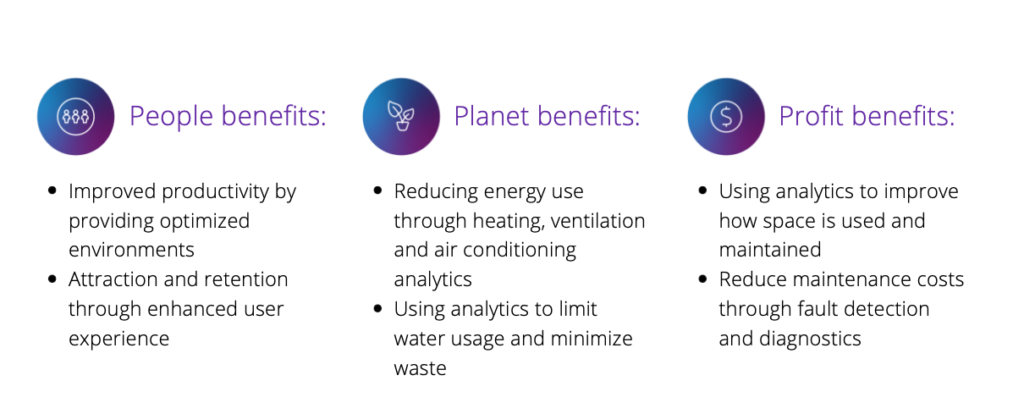

Technology is rapidly evolving across the real estate sector, where the market for smart buildings has exponentially grown and is estimated to be worth in excess of US$100 billion by 2025.

Arcadis’ Intelligent Building Practice have published research which highlights the benefits of intelligent buildings across people, planet and profit. It is no longer a question of ‘how much does an intelligent building cost?’ but ‘how much can my company benefit by working in an intelligent building?

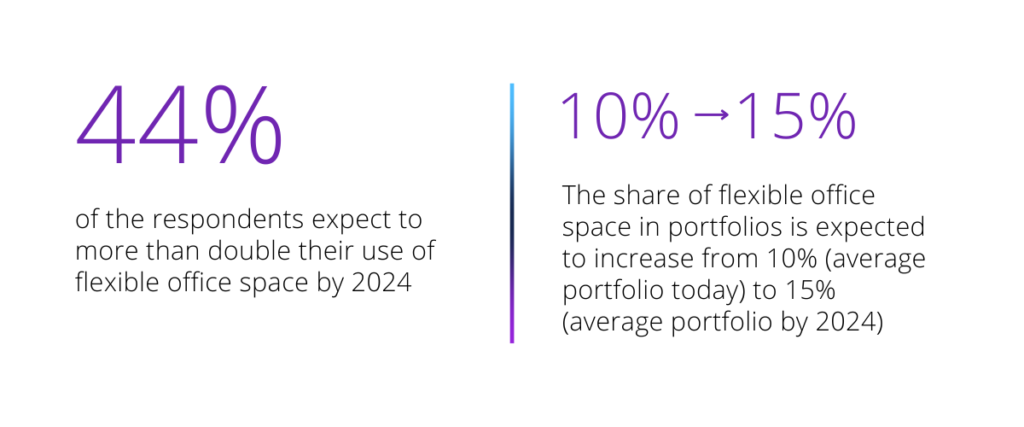

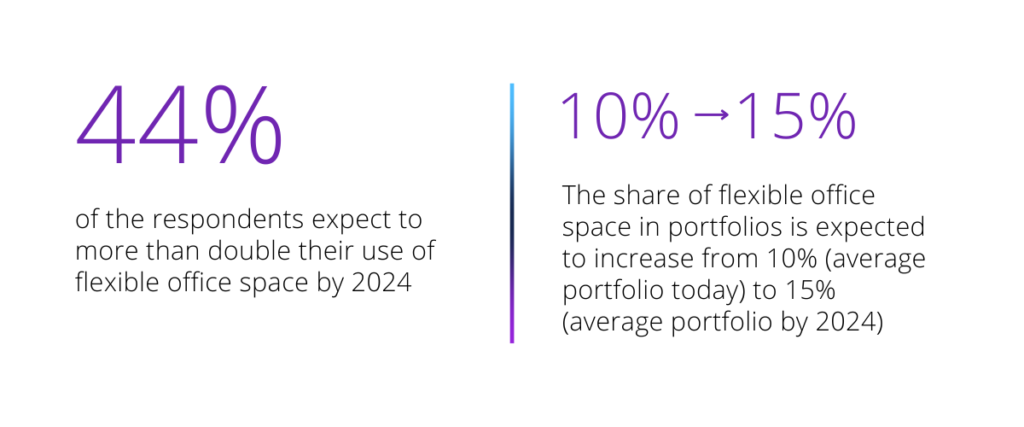

CBRE recently released their Flexible Office Trends in Life Sciences 2022 study, where they surveyed the Life Sciences practice group on their clients’ adoption of flexible office space and flexible lab space.

Results show that respondents think the biggest obstacles with adopting flexible office space are IT security, data privacy and cultural fit. The survey also shows that the use of flexible office space is expected to increase including findings such as

Traditionally, a commercial office fit out project would be categorised as either Cat A or Cat B. However, recently, in an attempt to adapt to ever more demanding occupier requirements, a new category has emerged, Cat A+. This new category combines all elements of a Cat A plus added features of a Cat B fitout. Cat A+ becomes what can be also referred to as ‘plug-and-play’ space, ready for occupiers with no delay.

React News reported on recently published research from RX London & Thirdway Group who looked into market performance of the early Cat A+ space available.

- Average Cat A+ unit size = 3.8k sq ft. The largest is 16k sq ft

- Compared to Cat A, Cat A+ net effective rent achieved is around 31% higher

- Marketing void periods typically halved in length with Cat A+ space