Landmark Space, the UK flexible workspace operator, has partnered with global technology and software company essensys to deploy transformational digital services across nine more London locations spanning 400,000 sq. ft.

Central London professionals are moving further towards a four day office week, according to thousands of devices monitored by essensys.

JLL’s latest research is based on the findings of a survey that asked over 1,000 real estate decision-makers around the world, how their organizations are planning for and implementing new technology.

Considering the challenges of the current market, 85% of respondents plan to increase their investment in technology over the next three years. However, companies are currently struggling to achieve their technology objectives, with fewer than 40% of organizations considering their existing tech programs to be very successful.

The report breaks the findings into 3 key areas:

For more insight, download your copy here.

CBRE Institute’s Fall 2023 report outlines 10 initiatives that CRE&F leaders may consider to navigate the current market challenges and reduce total cost of occupancy.

Learn more by reading the full report here.

The Instant Group’s latest market report looks at the business challenges impacting the flexible workspace industry across the UK. The report provides a current view of the market and compares this to pre-Covid market conditions.

Some of the key findings include:

Download your copy of the report here.

In a first for Chiswick Park, a business campus in West London, plug and play workspace will be brought to market providing greater flexibility and attracting a broader occupier mix.

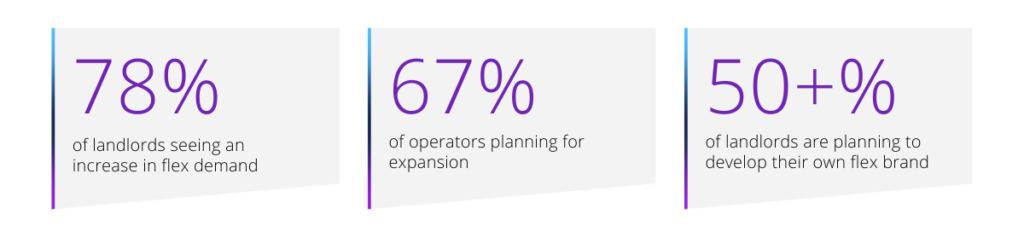

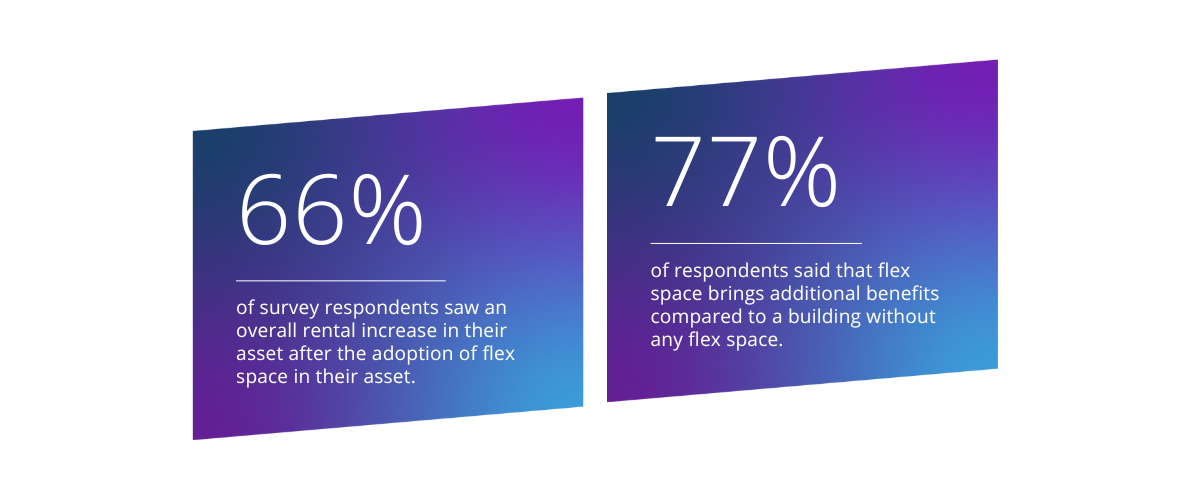

Flex workspace operator, Spacemade, surveyed office stakeholders to understand how offering flex space in an office building drives value. The findings show that the demand for flex is greater than ever, where landlords believe that the need for flex will only continue to grow.

Some of the key findings include:

Read the React News article here.

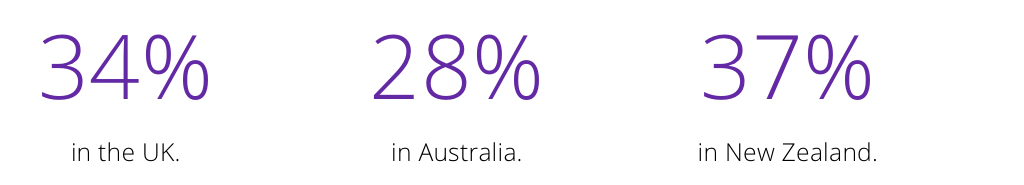

Recent data from Re-Leased reveals a notable decrease in the average length of office leases and a rise in short-term leases across UK, Australia and New Zealand. The data compares figures from Q1 2019 to Q1 2023.

Average lease lengths have declined by:

The article looks at the factors driving the shift and what implications this will have on the office market.

Read here.

essensys’ Chief Customer Officer, James Lowery, joined the Main Stage for the Technology and Engagement panel hosted by Jonathan Avery, Head of Technology & Data Real Assets, LGIM. We roundup the highlights from the panel in this blog.

Collier’s recent global report documents the differences in each region when considering the factors that impact office demand, supply, pricing and sentiment.

For example, in North America there are challenges in improving the return to office occupancy rates where vacancy is at a 16% average. Whereas, in Europe and APAC, vacancy rates are between 8-10% with occupancy rates almost matching pre-Covid figures.