Key takeaways from Cushman & Wakefield’s Q1 2023 U.S. Office MarketBeat include:

- Occupiers are looking for cost-cutting opportunities impacting leasing activity which has declined 23% quarter-over-quarter

- Increase in sublease availability which now accounts for 15% of overall vacancy

- Elevated vacancy likely to increase throughout 2023 but is expected to stabilize in 2024 as the economy recovers

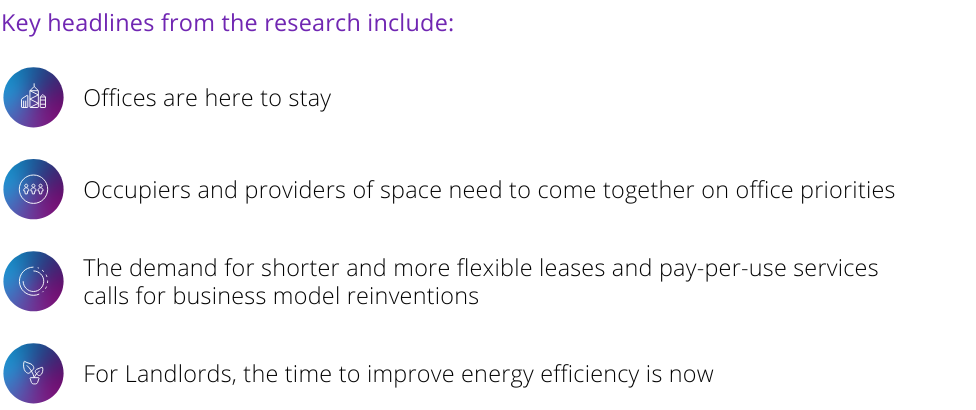

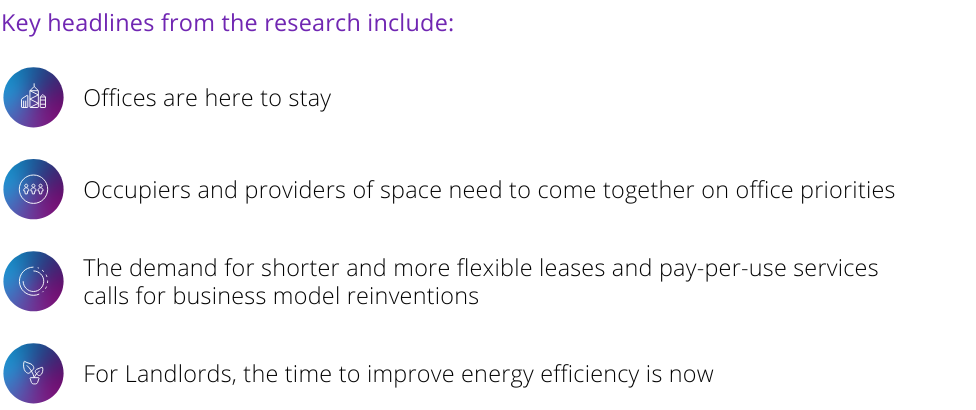

The Urban Land Institute and The Instant Group have surveyed office occupiers, landlords and third-party advisors globally to understand how changing occupier behaviours and broader macro trends impact the demand for workspace.

The findings show a disconnect between landlords and occupiers, therefore, aims to offer solutions to help landlords navigate the changing needs of their occupiers.

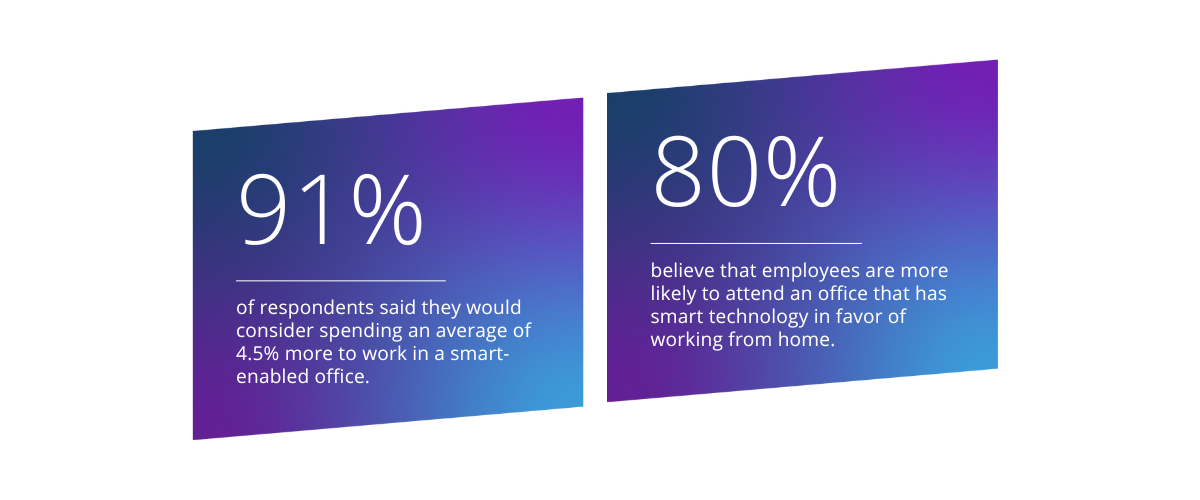

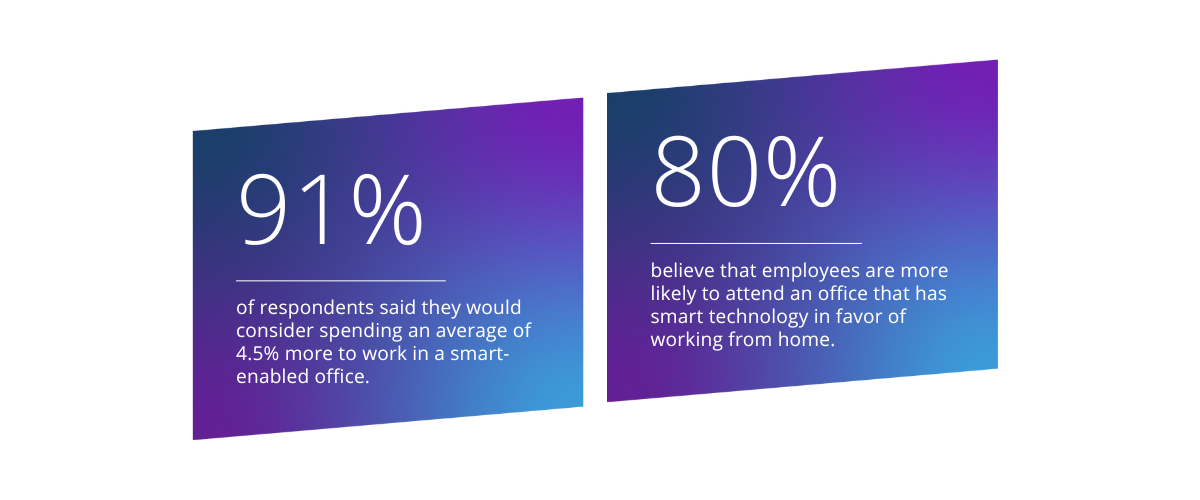

In WiredScore’s most recent report, they spoke to 1,000 real estate decision makers across North America to determine what they, and their employees, are looking for in an office space in the next five years.

Since the pandemic, the implementation of smart technology has dramatically increased as expectations from the modern workforce have changed, and occupiers are therefore willing to spend more on leasing space.

Smart technology will continue to play a pivotal role in the office market and Landlords must adapt to attract and retain occupiers in this competitive landscape.

Based on 300,000 employee responses collected by Leesman and analysis compiled from 200 industry resources by Gartner, this report from HqO showcases how workplace experience has evolved over the past year, what trends to expect in 2023, and what action real estate and employee experience leaders need to take.

Winners are chosen for their technological expertise and ability to adapt quickly.

The office market is currently in a divide between prime and secondary office buildings that will continue to widen in 2023. Demand for the best buildings in attractive locations will support rent growth in top-tier office towers. By contrast, there will be a smaller pool of tenants interested in older office buildings. As hybrid working remains desired, building owners will continue to look for ways to optimize their portfolios.

“We’re going to continue to see technological advancements being used in the office that really helps provide this seamless experience between people who are working in the office and meeting with clients that are in other locations. It’s going to be technology that helps people work together wherever they are. It’s less about me space and it’s more about we space – that’s what we continue to hear. It’s less space for desks, it’s not as much about cafes, it’s really about those meeting rooms and the technology that helps people get work done in a collaborative way.” – CBRE’s Head of Office Research, Jessica Morin

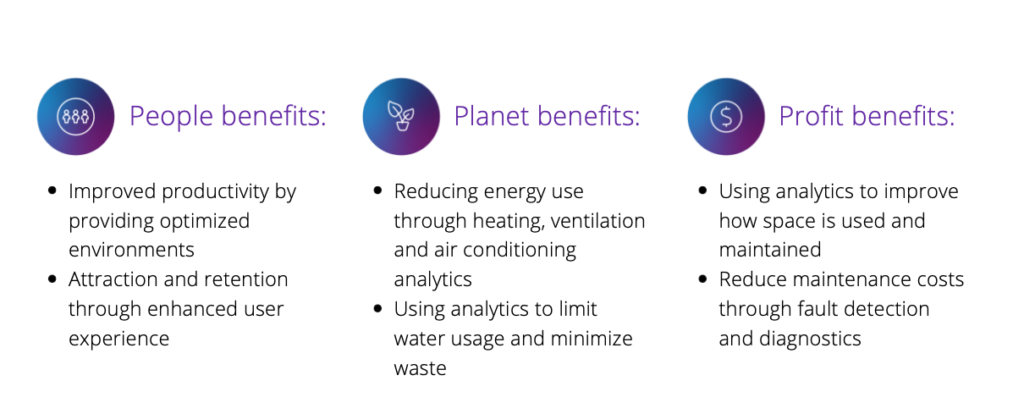

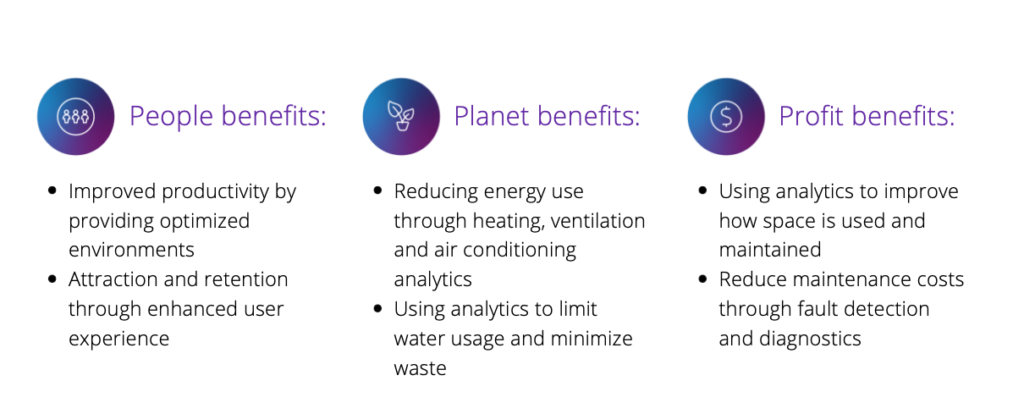

Technology is rapidly evolving across the real estate sector, where the market for smart buildings has exponentially grown and is estimated to be worth in excess of US$100 billion by 2025.

Arcadis’ Intelligent Building Practice have published research which highlights the benefits of intelligent buildings across people, planet and profit. It is no longer a question of ‘how much does an intelligent building cost?’ but ‘how much can my company benefit by working in an intelligent building?

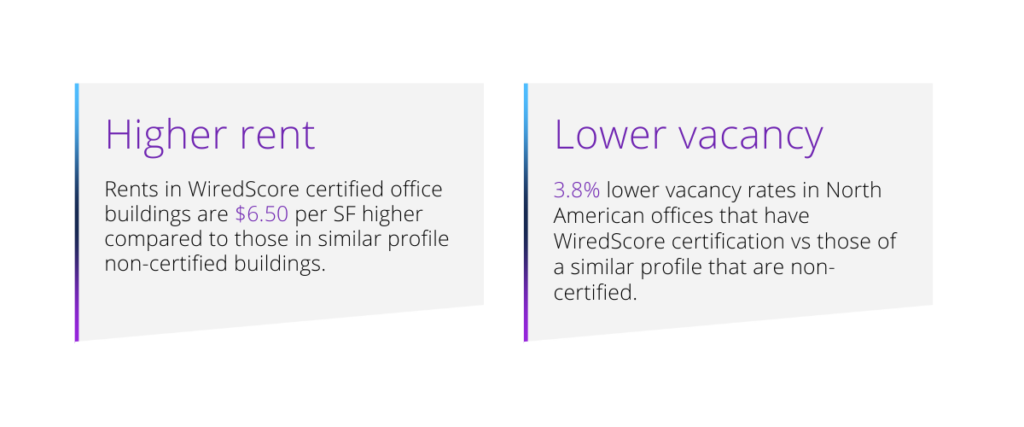

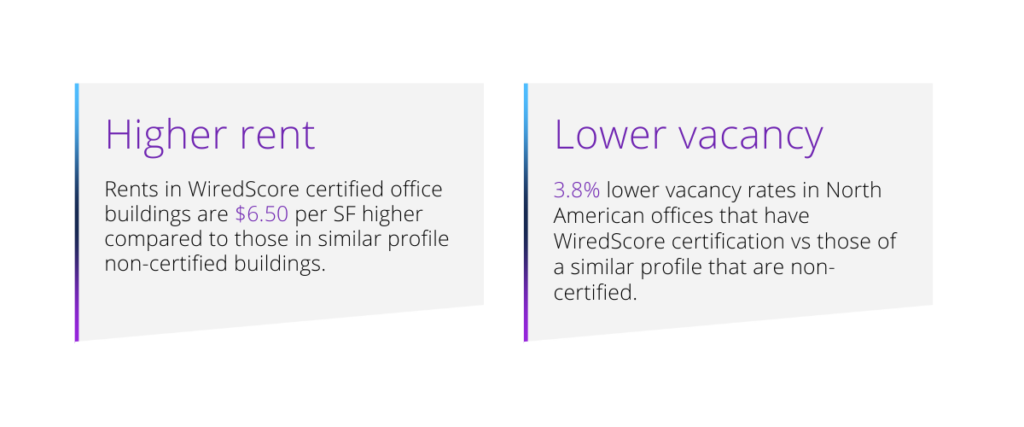

Analytics firm ‘Moody’s research on digital connectivity’s impact on CRE compares WiredScore certified buildings to non-certified. The study found that offices with better digital connectivity have better leasing performance than those without a digital certification — especially Class-B and C offices.

Read the full article here.

While short-term views on the current state of CRE are dim, many professionals remain reasonably optimistic when zooming out and looking ahead at the long-term view. In their latest report, PWC highlights the uncertainty that remains for the future of the office as many companies are still figuring out the best working strategy for their employees.

“In the short term, hedging bets often involves reducing office space moderately, renewing leases for shorter amounts of time, and embracing flexible lease strategies such as coworking.”

Key themes from this report:

- Workforce transformation

- Sustainability and climate change

- Deals and capital markets

- Migration to affordable housing

- Infrastructure spending

- Metaverse