Cushman & Wakefield’s new report highlights the high risk of obsolescence for office assets in Europe that don’t meet occupier demand or upcoming sustainability legislation.

Landlords are being urged to act now. The flight to quality trend is accelerating so those who reposition their portfolio to meet sustainability credentials and occupier’s expectations for greater flexibility, community and experience will be the ones who benefit.

“Cushman & Wakefield has formed a pan-European, multi-disciplinary team as part of a global response to the office sector’s need for rethinking, reimagination, repositioning and repurposing.”

Based on 300,000 employee responses collected by Leesman and analysis compiled from 200 industry resources by Gartner, this report from HqO showcases how workplace experience has evolved over the past year, what trends to expect in 2023, and what action real estate and employee experience leaders need to take.

Technology is rapidly evolving across the real estate sector, where the market for smart buildings has exponentially grown and is estimated to be worth in excess of US$100 billion by 2025.

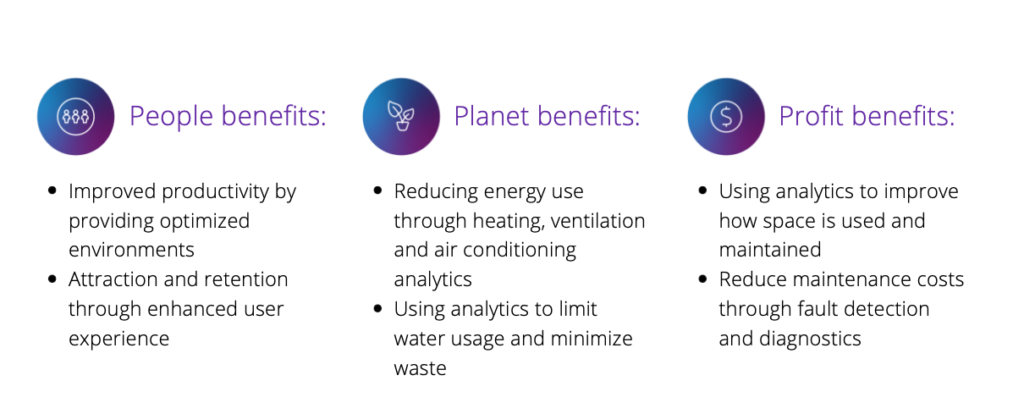

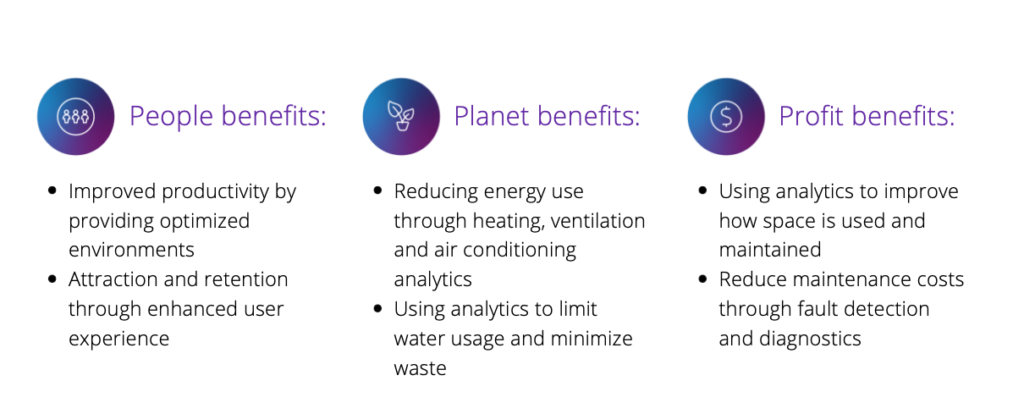

Arcadis’ Intelligent Building Practice have published research which highlights the benefits of intelligent buildings across people, planet and profit. It is no longer a question of ‘how much does an intelligent building cost?’ but ‘how much can my company benefit by working in an intelligent building?

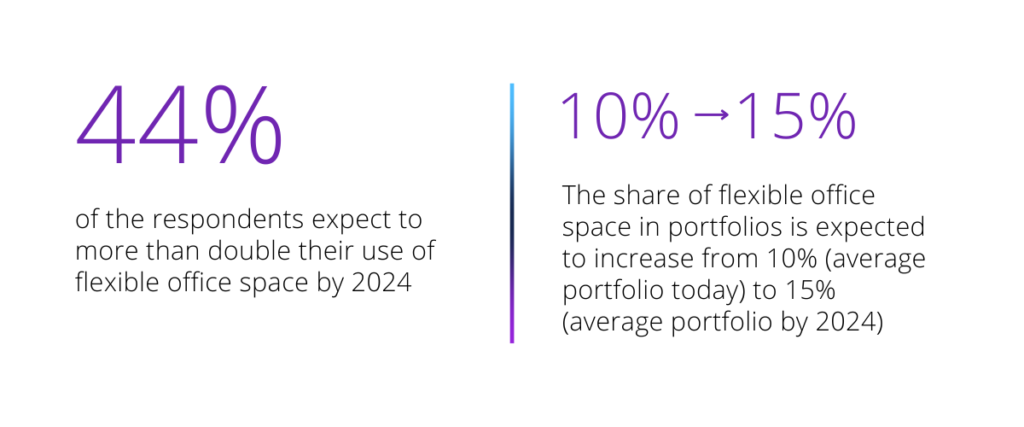

CBRE recently released their Flexible Office Trends in Life Sciences 2022 study, where they surveyed the Life Sciences practice group on their clients’ adoption of flexible office space and flexible lab space.

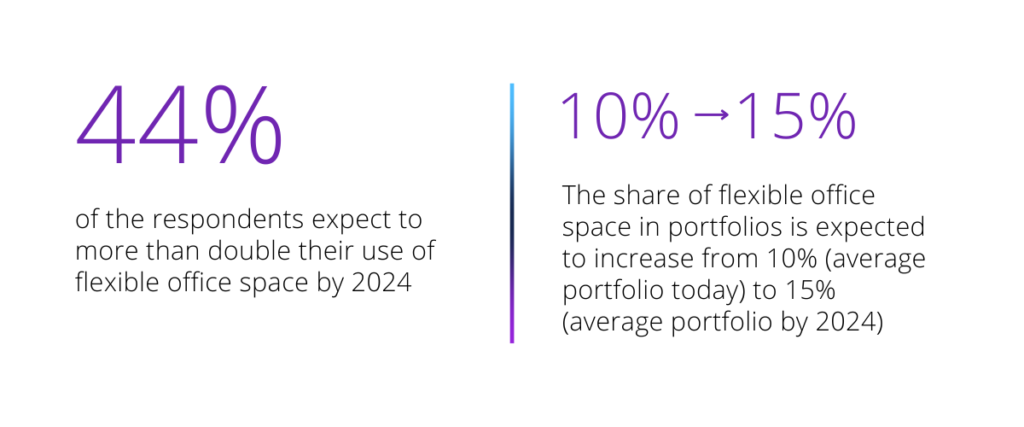

Results show that respondents think the biggest obstacles with adopting flexible office space are IT security, data privacy and cultural fit. The survey also shows that the use of flexible office space is expected to increase including findings such as

Traditionally, a commercial office fit out project would be categorised as either Cat A or Cat B. However, recently, in an attempt to adapt to ever more demanding occupier requirements, a new category has emerged, Cat A+. This new category combines all elements of a Cat A plus added features of a Cat B fitout. Cat A+ becomes what can be also referred to as ‘plug-and-play’ space, ready for occupiers with no delay.

React News reported on recently published research from RX London & Thirdway Group who looked into market performance of the early Cat A+ space available.

- Average Cat A+ unit size = 3.8k sq ft. The largest is 16k sq ft

- Compared to Cat A, Cat A+ net effective rent achieved is around 31% higher

- Marketing void periods typically halved in length with Cat A+ space

At a time when commercial occupancy rates across the country remain stubbornly low, the report delves into how Australian office worker expectations are changing in a digital-first, hybrid work environment and how this impacts their office attendance.

Next Flex | Technology for the next generation Australian office, which surveyed 1,000 office workers across the country, was launched by essensys, a leading global provider of software and technology for the commercial real estate industry, in partnership with Flexible Workspace Australia.

- 85% of survey respondents, especially workers under 41, want to work in a flexible workspace near their homes, at least as much as their primary offices

- 57% of Australian office workers say that their office is not equipped for a flexible, seamless, agile work experience

- More than 2 in 5 (41%) feel simple tasks take too long in the office due to the standard of their in-office technology

- More than 90% of Millennials and Generation Z employees experience a gap between the technology currently offered in their office and what’s needed to do their jobs effectively

As organizations put aside their continuous readjustments to the return to the office and shift towards a long-term transformation to the new future of work, systemic and robust organizational resilience will be fundamental to sustain this new working structure.

Learn more about resilience in the built environment and its importance as organizations transform their real estate operational models and build their competitive advantage.

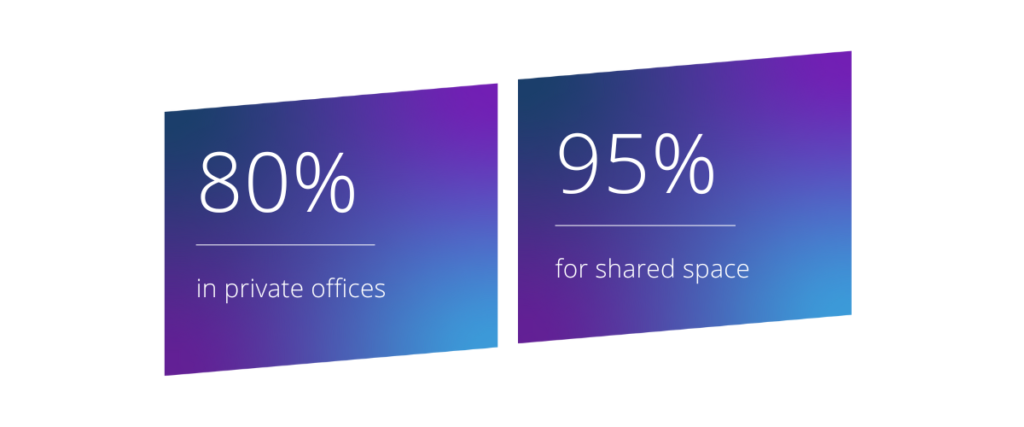

Savills recently published the Autumn edition of their ‘European Flex Offices’ report.

They report rising occupancy levels in flex space across Europe; they believe the core driver here is the adaptability flexible space gives occupiers during uncertain economic times. It allows them to trial different company policies when it comes to hybrid working. An additional driver the report looks at is the enhanced service offering occupiers have access to when utilising flexible space. With heightened expectations, businesses are becoming more willing to pay additional rent for enhanced services and amenities as opposed to coordinating this themselves.

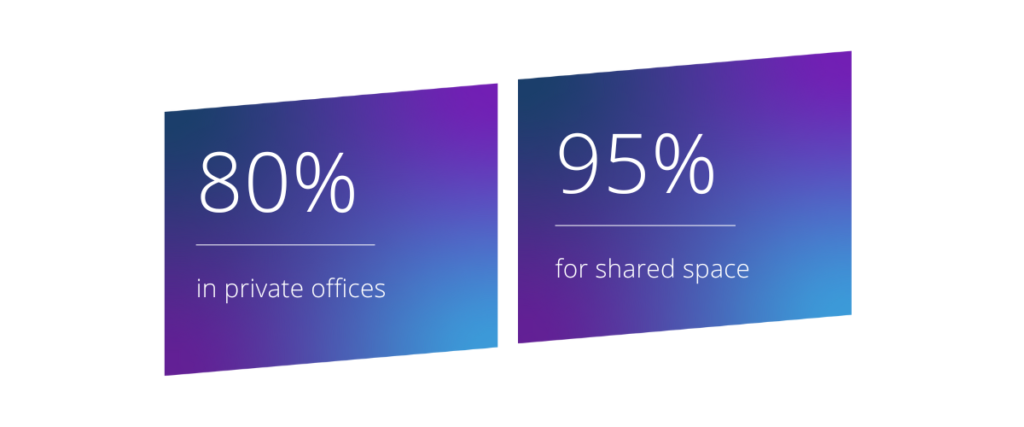

Flex contract occupancy rates are back to pre-pandemic levels of over…

The Partnership for New York City surveyed more than 160 major Manhattan office employers between August 29 and September 12, 2022, to gauge the extent to which employees have returned to the office or are still working remotely. There has been a nearly 30% increase in Manhattan workers who are in the office on any given workday. Fully remote office workers have also seen their totals drop just over 50% in the same time period.

Employers remain committed to staying in New York City: 54% expect their office employee headcount will increase or stay the same over the next five years; only 10% expect a decline.