The top five operational metrics for multi-site flex-space operators

A flex-space operation is inherently complex. Delivering great member and tenant experiences can be extremely challenging when you consider varying tenant needs, service requirements and the plethora of tools supporting real world flex scenarios. Not to mention that service provisioning is not happening in a vacuum but in a competitive market where the lines are blurring between traditional and flex space providers. The bottom line is that reporting on the right metrics is critical to understand how effective your business and services are to your tenants and to accurately predict future performance.

But where should you start?

On a recent webinar, we spoke with industry experts about how metrics and data reporting can have a massive impact on a flexible workspace operation. Proptech guru Antony Slumbers, Liz Elam, Executive Director of GCUC, and David Kinnaird, COO at essensys, provide insight into flex-space metrics 101 and beyond.

Below we summarize the top five metrics underpinning a successful flex-space operation.

Revenue

Revenue calculations are based on your total square footage. This means that the price per square foot (or square meter) is the crux of your entire operation. To be profitable, you must optimize the revenue-generating power behind each and every square foot.

Depending on your business model, a widely accepted benchmark for revenue is 80% monthly rent to 20% additional services such as meeting rooms, IT and telecoms services, events, and café services.

Have you heard of REVPOW or REVPAW? Learn how to calculate these two key metrics.

Occupancy

Occupancy rate is your primary revenue driver and it’s evaluated by space and workstation. There isn’t one standard occupancy rate that can determine profitability for operators across the board. Every business model and workspace are different, so it will come down to how your RSF (rentable square feet) are distributed across revenue-generating spaces and non-revenue generating spaces.

Rate per square foot

Your business model requires you to have break-even and profitability numbers. Once these numbers have been established in your budget, you can determine the price per square foot that you’ll list your space and services. This metric allows your landlord to compare your space to other asset classes he is familiar with such as traditional long-term office lease offices or hotels.

Keep your rate per square foot competitive based on local and regional criteria. Every square foot should be considered from a value perspective. By default, does that space extend additional services or offer a premium location? If so, this value should be accounted for within the rate per square foot.

Learn from industry experts how to boost the value of your workspace.

Service revenue

Tracking supplemental services and amenities revenue is key. Extending these services is an organic way of increasing wallet share and new revenue streams. A significant share of revenues can come from non-desk related activities such as bespoke tech services, training, events or food and beverage. Because service revenues don’t exist in traditional office leases, they can boost your appeal to landlords as a flex-space operator. They also benefit your bottom line and should be tracked.

Add value to your tenants and drive new revenue streams.

Customer lifetime value

By nature of occupier demand for shorter office leasing terms and flexibility requirements, your customer base may change more frequently. Combine this with more flex-space options in the market means that it’s even more essential to keep tabs on customer lifetime value. It will help you determine which customer are worth renewing at discounted or premium rates. Really understanding your customers and demographics will better position your business to target the right market segments that can grow your business and continue adding value.

With complete visibility over your portfolio you can improve decision making, spot problem areas and identify new opportunities across your operation and boost your bottom line!

Featured

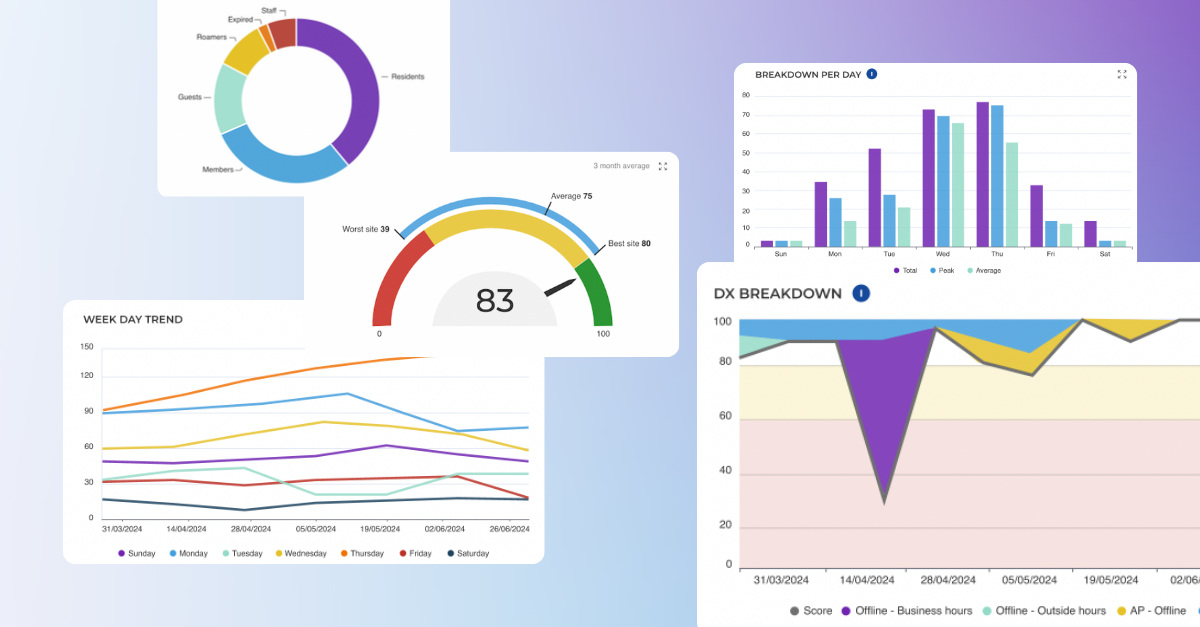

Introducing Intelligence Engine 🎉 Powering meaningful space utilisation & digital experience insights

Intelligence Engine capabilities propels us into a new era of workspace management, bringing meaningful Space Utilisation and Digital Experience insights to essensys Platform.

Read the article

Featured

Future of flex in Europe: attracting and retaining enterprise customers

Gaël Montassier, Co-founder of Startway, shares his insights on the future of flexible workspace in Europe.

Read the article