Flex growth in Europe: what’s driving its take up?

Savills recently published their ‘European Flex Offices’ Autumn edition. It looks at flexible space growth across Europe as well as the drivers behind occupier take up of flexible space. We’ve summarised the report and provided some key takeaways in this article.

Flex growth in Europe

The demand for flexible office space across Europe accounted for 5% of office take up across the continent during the first half of 2022. This is an increase on the 3% that was experienced during the pandemic and on its way to the 8% we saw pre-pandemic.

The report highlights Paris CBD, Amsterdam and Lisbon as the most active flexible workspace markets of the past 18 months. Paris CBD is emerging as one of Europe’s fastest growing hubs for flexible office space; in H1 of 2022, flexible workspace made up 20%of office take up in the city which equates to 45,000 sqm of space. Another market of note in the report was Barcelona; in the first half of the year, an additional 20,000 sqm of flexible space entered the market.

The German market has experienced lower levels of flexible space demand in this time; Savills have attributed this to a “more traditional working culture and more cellular office layouts”.

The average size of a flexible space deal in Europe is between six and eight desks, however there is a rise of enquiries for spaces that can cater for between 50 and 200 desks.

Andrew Debenham, SVP of Customer Development at essensys said, “The general feeling from our flex operator customers is that occupancies are back to where they were before Covid and enquiry levels are generally strong.

It’s now a case of trying to increase revenue by keeping tenants happy. Enquiries for larger amounts of office space is definitely true, particularly given the rise of plug and play spaces which cover the gaping hole between a coworking space and a traditional long-term lease.

Many prime city centre markets (such as Paris) are still strong for traditional leasing so the need for landlords to convert space to flex is low. Where vacancies are lower, landlords are looking at flex and occupier experience to appease existing lease hold tenants rather than attract new ones. Some in this situation are looking at tenant engagement apps which essentially offer common area services rather than ‘flex’ which provides services within tenant offices”.

Why are companies opting for Flex?

Three drivers for the growth of flex were highlighted by Savills: flexible lease term fitout costs and enhanced service offering.

Flexible term length: The adaptability that flexible space offers occupiers in uncertain economic times is highly valuable. It enables organisations to trial different company policies regarding hybrid working or mandatory office days as well tackle more nimbly the need to either shrink or grow their office footprint.

Fitout costs: Utilising flexible space reduces (at times eliminates) the capex requirements on fit outs when moving into new space. One of the benefits of flexible space is that it requires limited adaptation from the incoming occupier and so they can move in quickly and efficiently. So not only does flexible space help reduce fitout cost, it also increases an occupiers speed to occupation.

Enhanced service offering: Often located in prime locations, flex offerings tend to include enhanced services and amenities. With occupier expectations rising, for companies that want staff to come back to the office as part of a hybrid approach to working, they’re more “willing to pay the additional rent for a fully serviced office offering” rather than procure and manage a facilities management arm.

Access the Savills report: You can access the full report here.

Get ready for new research on occupier sentiment, soon to land: essensys are soon to publish the findings of a UK-wide office worker survey that acts as a snapshot of current occupier sentiment. We asked workers what technology entices them back to the office as well as what puts them off returning and hinders their productivity. This research is due for publication in November and will be freely available on our website. Follow us on LinkedIn for a reminder to access the research once it’s published.

Featured

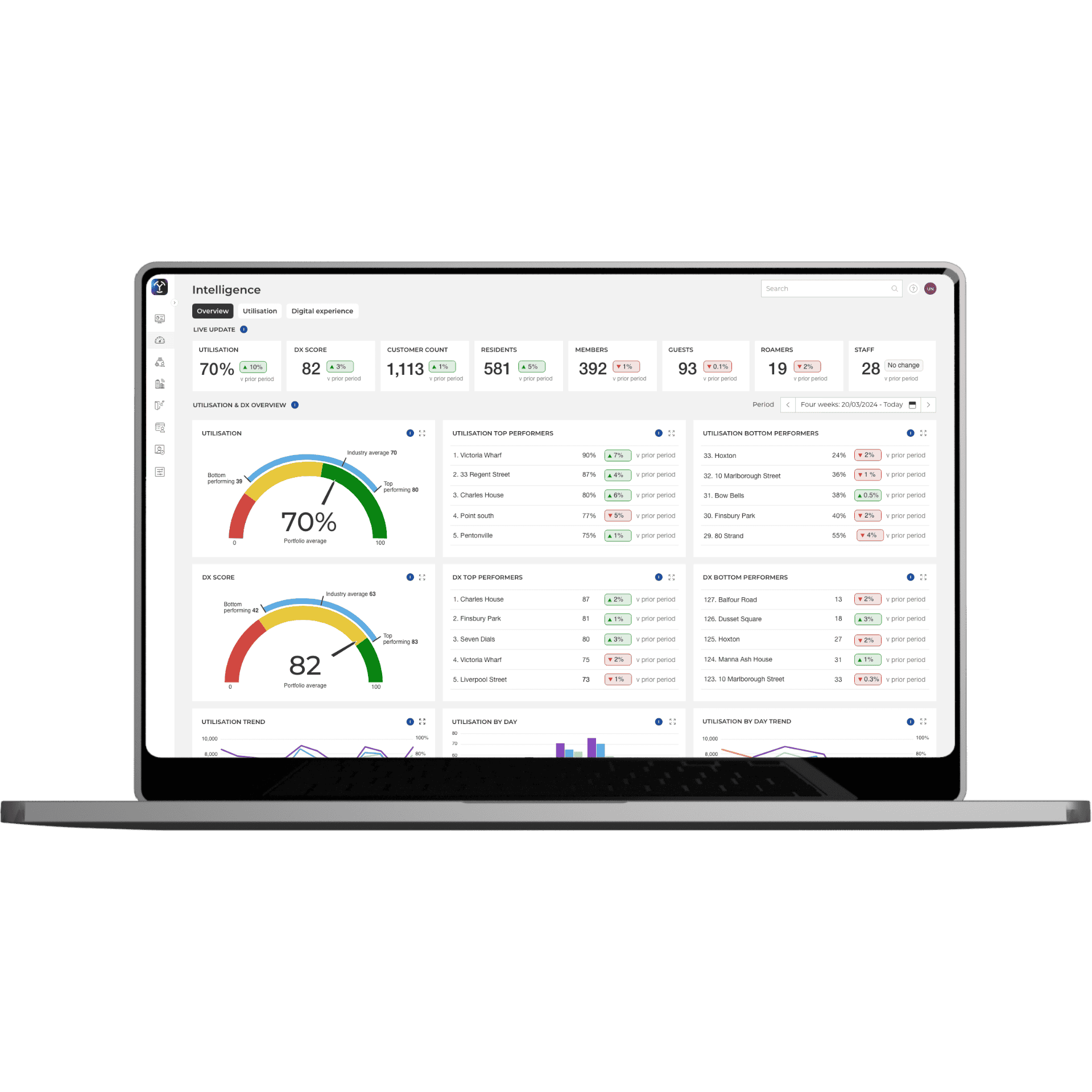

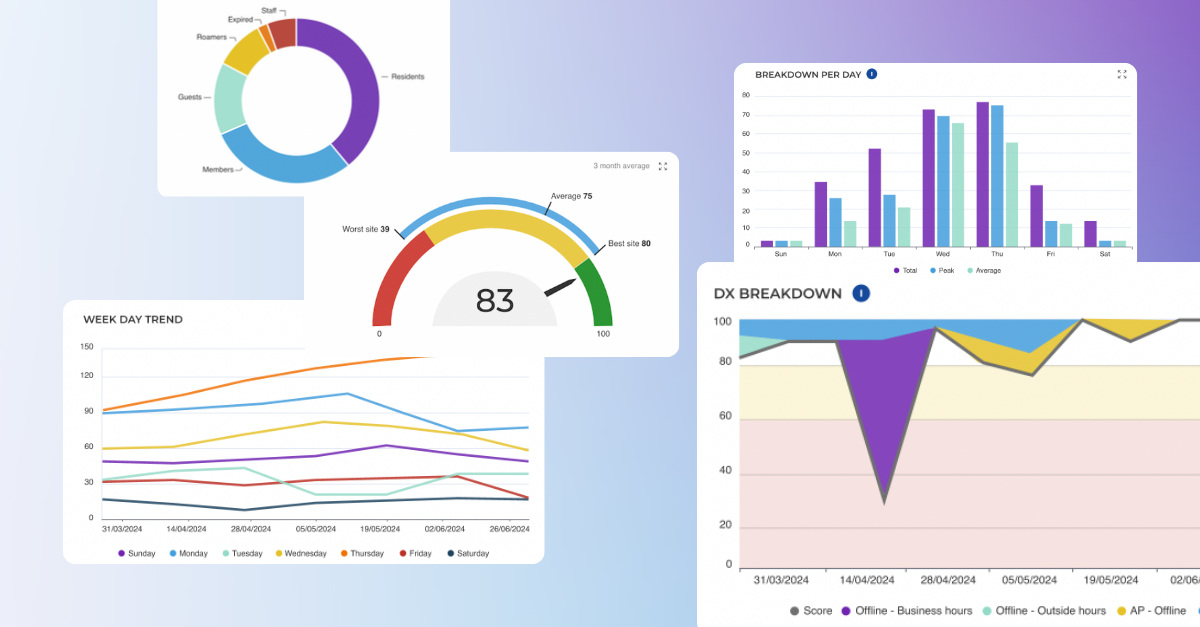

3 ways to increase yield using insights 🚀 with essensys Platform Intelligence Engine

Three ways to increase yield across your portfolio, using insights from essensys Platform Intelligence Engine.

Read the article

Featured

Introducing Intelligence Engine 🎉 Powering meaningful space utilisation & digital experience insights

Intelligence Engine capabilities propels us into a new era of workspace management, bringing meaningful Space Utilisation and Digital Experience insights to essensys Platform.

Read the article