PwC have published their top real estate industry trends for 2024 report and here are some of the highlights when regarding the office sector:

Hybrid is here to stay – 30% of total workdays in the United States now involve remote work, as revealed by WFH Research, with 45.9% of workers adopting a hybrid approach (33.7% spending an average of 2.5 days per week in the office) or working fully remotely (12.1%) as of summer 2023.

Improving tech is key – Future offices should prioritize advanced technology, evolving efficient collaboration, providing well-defined spaces, enhancing experiential value, and incorporating designs that meet employee needs for increased productivity.

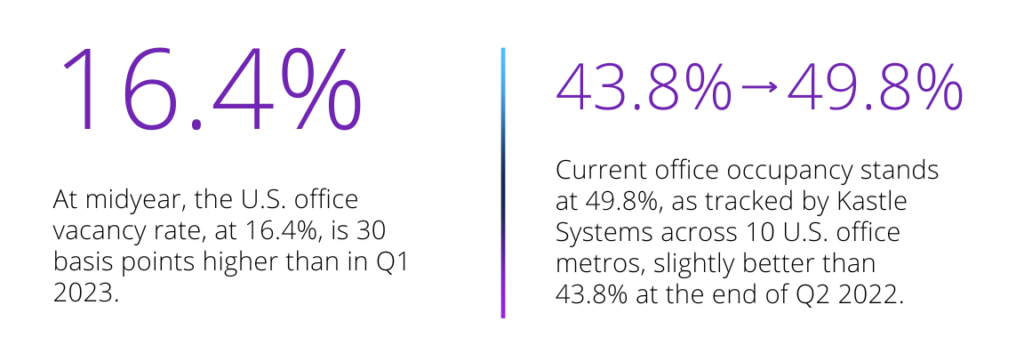

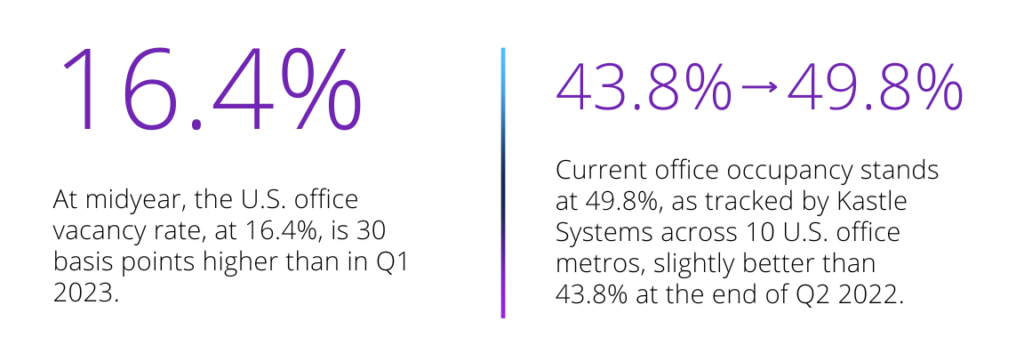

Tenant demands – Tenants now demand higher spending on improvements while occupying less space. Weak office absorption and rising vacancies persist, with a national vacancy rate in the high teens.

Long term success – Despite the negative outlook, the majority office buildings are performing well, where occupancy rates have either improved or stayed the same since 2020. The pandemic has spurred initiatives to redevelop obsolete office buildings where over 100 million square feet are under construction as of September 2023, according to CommercialEdge.

Central London professionals are moving further towards a four day office week, according to thousands of devices monitored by essensys.

JLL’s latest research is based on the findings of a survey that asked over 1,000 real estate decision-makers around the world, how their organizations are planning for and implementing new technology.

Considering the challenges of the current market, 85% of respondents plan to increase their investment in technology over the next three years. However, companies are currently struggling to achieve their technology objectives, with fewer than 40% of organizations considering their existing tech programs to be very successful.

The report breaks the findings into 3 key areas:

CBRE Institute’s Fall 2023 report outlines 10 initiatives that CRE&F leaders may consider to navigate the current market challenges and reduce total cost of occupancy.

Collier’s Q2 report looks at the current economic and real estate trends in the U.S. office markets and deep dives into local trends, uncovering what is declining, stabilizing or showing signs of recovery.

Recent research from the McKinsey Global Institute has modeled future demand for office, residential, and retail space in several scenarios. Findings based on these scenarios indicate that:

- Hybrid work is here to stay. As a result, office attendance has stabilized at 30 percent below prepandemic norms.

- Demand for office and retail space in superstar cities will remain below prepandemic levels. In a moderate scenario that McKinsey modeled, demand for office space is 13 percent lower in 2030 than it was in 2019 for the median city in the study.

- Real estate is local, and demand will vary substantially by neighborhood and city. Demand may be lower in neighborhoods and cities characterized by dense office space, expensive housing, and large employers in the knowledge economy.

- Cities and buildings can adapt and thrive by taking hybrid approaches themselves. Priorities might include developing mixed-use neighborhoods, constructing more adaptable buildings, and designing multiuse office and retail space.

As many organizations are now adopting hybrid-working strategies to create a more flexible and inclusive environment, having the right technology is imperative to ensure maximum productivity.

Collier’s recent global report documents the differences in each region when considering the factors that impact office demand, supply, pricing and sentiment.

For example, in North America there are challenges in improving the return to office occupancy rates where vacancy is at a 16% average. Whereas, in Europe and APAC, vacancy rates are between 8-10% with occupancy rates almost matching pre-Covid figures.

Knight Frank | Cresa’s data analysis has been shaped from 640 worldwide companies set against ever-evolving real estate ambitions. (Y)OUR SPACE investigates how the future of the workplace is likely to unfold over the next three years.

Results show that corporate real estate professionals believe complexity in the market is going to increase when considering business strategy, decision making, the workplace, to pick a few.

In addition, the majority of respondents believe their organisation’s work style will be hybrid three years from now at 55.7% followed by office first at 23.2% and remote first last at only 3.4%.

Key findings from Avison Young’s Q1 2023 U.S. market overview include:

- Leasing activity slowed to the second-weakest amount since 2001, -42.2% from 2001 to Q1 2020 and -27.5% from post-COVID averages.

- Flight to quality remains pronounced, especially in markets such as Manhattan (+28.4%) where new construction demand is strong.

- Sublease availabilities increased to a new record in Q1 2023, more than doubling from Q1 2020 levels as tenants continue cost containment efforts.

- Tenant leverage has accelerated in U.S. gateway markets, with landlords offering more generous free rent periods and tenant improvement allowances.

- Tenants have refocused on sustainability, especially in a supply-rich market. LEED Platinum offices have consistently outperformed peer properties.