In Savill’s European Office Outlook, they share the top five office themes that they believe are impacting occupancy.

- Occupancy rates – are we reaching the ‘new norm’?

- Demand – who will be taking space?

- Vacancy rates to peak in 2024

- Office development starts to ease back

- Rental growth – the best versus the rest

JLL’s latest research is based on the findings of a survey that asked over 1,000 real estate decision-makers around the world, how their organizations are planning for and implementing new technology.

Considering the challenges of the current market, 85% of respondents plan to increase their investment in technology over the next three years. However, companies are currently struggling to achieve their technology objectives, with fewer than 40% of organizations considering their existing tech programs to be very successful.

The report breaks the findings into 3 key areas:

CBRE Institute’s Fall 2023 report outlines 10 initiatives that CRE&F leaders may consider to navigate the current market challenges and reduce total cost of occupancy.

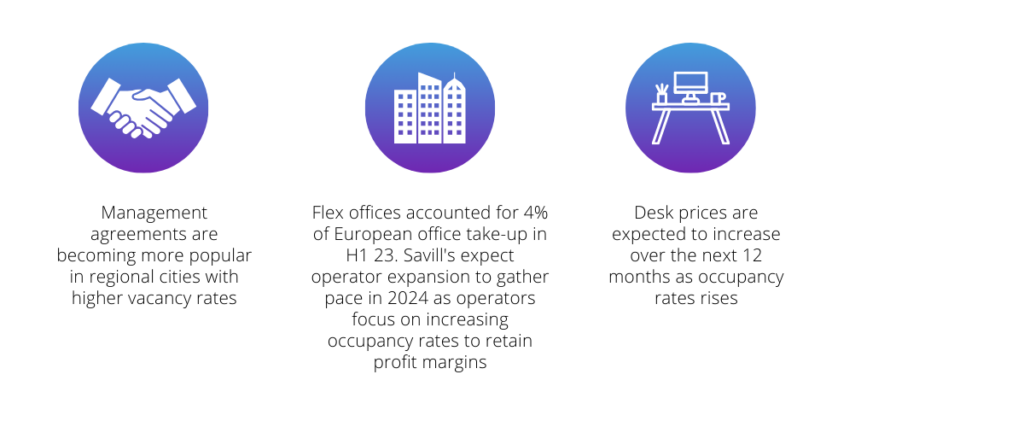

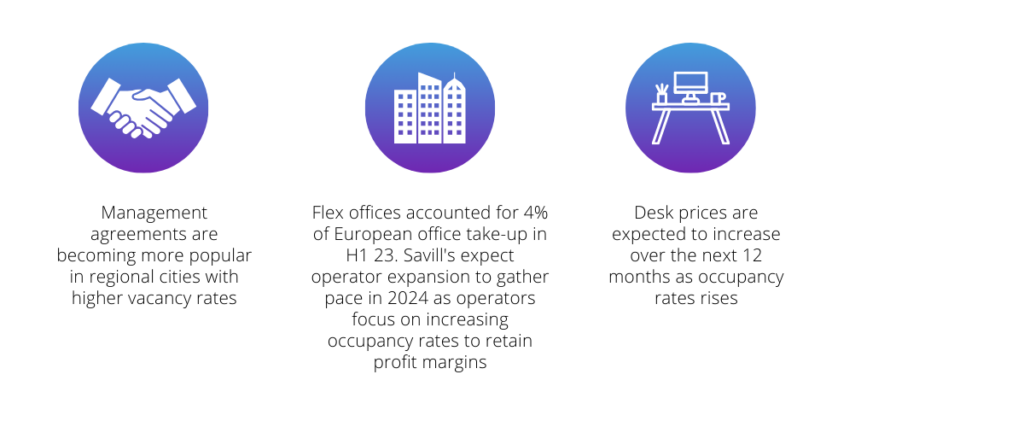

Savill’s European Flexible Offices report provides an overview of the market trends in European cities where flex take-up is prominent.

Key takeaways:

CBRE’s recent European Flex Office Market Update looks at occupier and operator sentiment alongside market penetration, but most importantly highlights a growing shift towards sustainable practices.

La vision d’un bâtiment intelligent tout-en-un peut sembler être un rêve futuriste, mais explorons ensemble le paysage actuel et les possibilités.

Collier’s recent global report documents the differences in each region when considering the factors that impact office demand, supply, pricing and sentiment.

For example, in North America there are challenges in improving the return to office occupancy rates where vacancy is at a 16% average. Whereas, in Europe and APAC, vacancy rates are between 8-10% with occupancy rates almost matching pre-Covid figures.

Knight Frank | Cresa’s data analysis has been shaped from 640 worldwide companies set against ever-evolving real estate ambitions. (Y)OUR SPACE investigates how the future of the workplace is likely to unfold over the next three years.

Results show that corporate real estate professionals believe complexity in the market is going to increase when considering business strategy, decision making, the workplace, to pick a few.

In addition, the majority of respondents believe their organisation’s work style will be hybrid three years from now at 55.7% followed by office first at 23.2% and remote first last at only 3.4%.

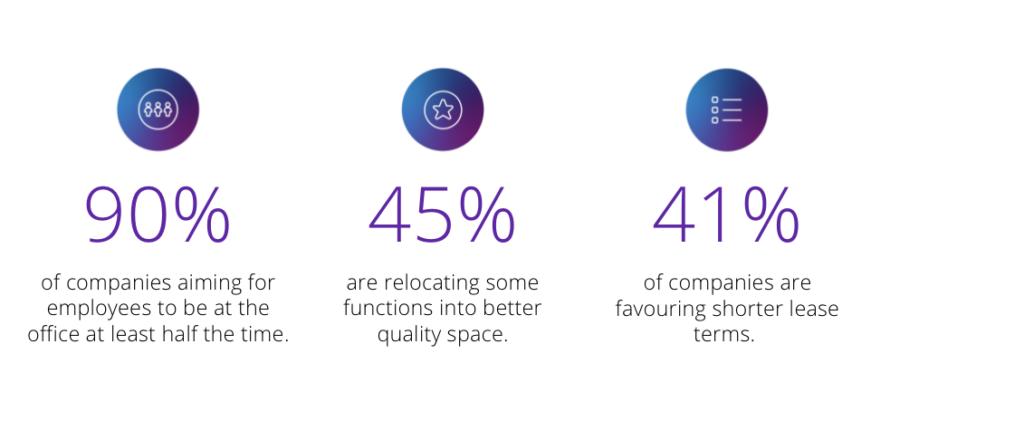

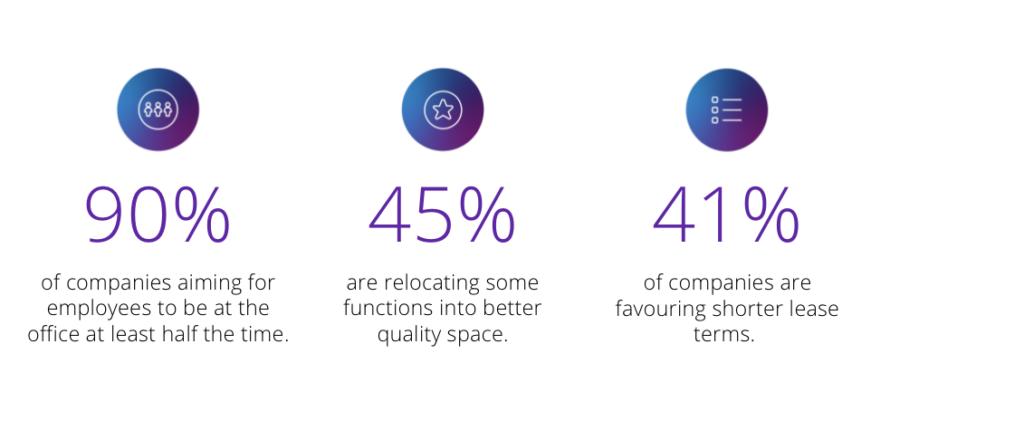

CBRE’s 2023 European Office Occupier Sentiment Survey polled over 130 companies on a range of issues including; return to the office, portfolio optimisation, attitudes to flex office space for example.

Key findings include:

- There is scope for office return rates to rise as policies are tightening.

- Portfolio optimisation: focus on lease structures and flex office space.

- Location strategies: space located near public transport and sustainable features are of growing importance.

- Technology needed to support new work styles: enhanced video conferencing and room booking software.

- People-centric goals are at the forefront of future of work policies.

The Urban Land Institute and The Instant Group have surveyed office occupiers, landlords and third-party advisors globally to understand how changing occupier behaviours and broader macro trends impact the demand for workspace.

The findings show a disconnect between landlords and occupiers, therefore, aims to offer solutions to help landlords navigate the changing needs of their occupiers.