JLL’s latest research is based on the findings of a survey that asked over 1,000 real estate decision-makers around the world, how their organizations are planning for and implementing new technology.

Considering the challenges of the current market, 85% of respondents plan to increase their investment in technology over the next three years. However, companies are currently struggling to achieve their technology objectives, with fewer than 40% of organizations considering their existing tech programs to be very successful.

The report breaks the findings into 3 key areas:

CBRE Institute’s Fall 2023 report outlines 10 initiatives that CRE&F leaders may consider to navigate the current market challenges and reduce total cost of occupancy.

Flexible Workspace Australia’s recent industry report looks at the future of flex in Australia but also shares a global snapshot in statistics.

You will also find insights from industry experts on what their businesses are experiencing in the current market and what their focus is for the future.

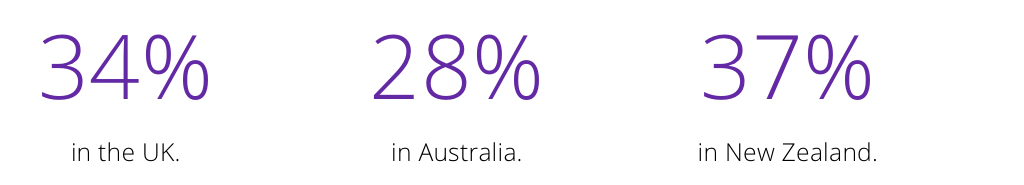

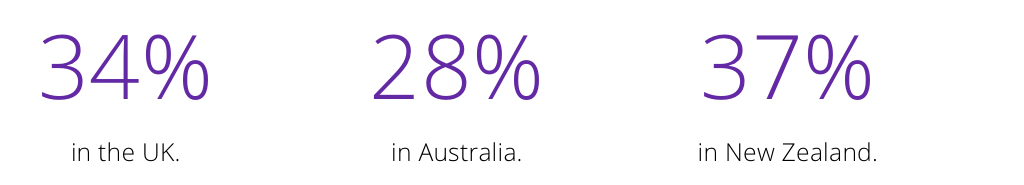

Recent data from Re-Leased reveals a notable decrease in the average length of office leases and a rise in short-term leases across UK, Australia and New Zealand. The data compares figures from Q1 2019 to Q1 2023.

Average lease lengths have declined by:

The article looks at the factors driving the shift and what implications this will have on the office market.

Collier’s recent global report documents the differences in each region when considering the factors that impact office demand, supply, pricing and sentiment.

For example, in North America there are challenges in improving the return to office occupancy rates where vacancy is at a 16% average. Whereas, in Europe and APAC, vacancy rates are between 8-10% with occupancy rates almost matching pre-Covid figures.

Knight Frank | Cresa’s data analysis has been shaped from 640 worldwide companies set against ever-evolving real estate ambitions. (Y)OUR SPACE investigates how the future of the workplace is likely to unfold over the next three years.

Results show that corporate real estate professionals believe complexity in the market is going to increase when considering business strategy, decision making, the workplace, to pick a few.

In addition, the majority of respondents believe their organisation’s work style will be hybrid three years from now at 55.7% followed by office first at 23.2% and remote first last at only 3.4%.

The Urban Land Institute and The Instant Group have surveyed office occupiers, landlords and third-party advisors globally to understand how changing occupier behaviours and broader macro trends impact the demand for workspace.

The findings show a disconnect between landlords and occupiers, therefore, aims to offer solutions to help landlords navigate the changing needs of their occupiers.

Based on 300,000 employee responses collected by Leesman and analysis compiled from 200 industry resources by Gartner, this report from HqO showcases how workplace experience has evolved over the past year, what trends to expect in 2023, and what action real estate and employee experience leaders need to take.

Technology is rapidly evolving across the real estate sector, where the market for smart buildings has exponentially grown and is estimated to be worth in excess of US$100 billion by 2025.

Arcadis’ Intelligent Building Practice have published research which highlights the benefits of intelligent buildings across people, planet and profit. It is no longer a question of ‘how much does an intelligent building cost?’ but ‘how much can my company benefit by working in an intelligent building?